What's New?

What's New?

December 17, 2025 - Happy HolidaysURS will be closed on Thursday December 25 and Friday December 26. We will re open on Monday December 29 at 8:30 a.m. EST should you have any year-end service needs.

We will also be closed on Thursday, January 1, 2026 as we celebrate the New Year. We will re-open on Friday, January 2, 2026 at 8:30 a.m. EST.

URS Compliance will be closed on Thursday, November 27 and Friday, November 28 for the Thanksgiving holiday. We will reopen on Monday, December 1 at 8:30 AM EST.

September 22, 2025 - NIO SummitWe are excited to announce that URS Compliance will be exhibiting at NIO Summit 2025 (Nonprofit Innovation & Optimization Summit) on Sep 30 - Oct 02, 2025. 🎉🎉 Contact Us today to learn more about the NIO Summit and our turn-key compliance services.

June 27, 2025 - Independence Day

June 27, 2025 - Independence Day

Our offices will be closed on Friday, July 4th. We'll be back and ready to assist you on Monday, July 7th at 8:30 AM EST. Wishing you a safe and happy Independence Day!

May 23, 2025 - Memorial DayURS Compliance Services will be closed on Monday, May 26 in observance of Memorial Day. We will reopen on Tuesday, May 27 at 8:30 a.m. ET.

March 24, 2025 - FinCEN BOI Rule UpdateOn March 21, 2025, the Financial Crimes Enforcement Network (FinCEN) issued an interim final rule removing the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) under the Corporate Transparency Act (CTA). However, entities that are formed under the law of a foreign country that have registered to do business in a U.S. state or Tribal jurisdiction by filing with a secretary of state or similar office are still required to report their BOI. These entities must file within 30 days of the rule’s publication.

December 24, 2024 - Revised BOI Report Filing Due Dates

- Reporting companies that were created or registered prior to January 1, 2024, have until January 13, 2025, to file their initial beneficial ownership information reports with FinCEN. (These companies would otherwise have been required to report by January 1, 2025.)

- Reporting companies created or registered in the United States on or after September 4, 2024, that had a filing deadline between December 3, 2024, and December 23, 2024, have until January 13, 2025, to file their initial beneficial ownership information reports with FinCEN.

- Reporting companies created or registered in the United States on or after December 3, 2024, and on or before December 23, 2024, have an additional 21 days from their original filing deadline to file their initial beneficial ownership information reports with FinCEN.

- Reporting companies that qualify for disaster relief may have extended deadlines that fall beyond January 13, 2025. These companies should abide by whichever deadline falls later.

URS Compliance will be closed on Thursday, November 28, 2024 and Friday, November 29, 2024 in observance of the Thanksgiving holiday. We will re-open on Monday, December 2, 2024 at 8:30 a.m. ET.

October 29, 2024 - FinCEN Hurricane Relief Extension for BOI ReportsThe Financial Crimes Enforcement Network (FinCEN) announced that businesses impacted by recent hurricanes may qualify for a six-month extension to submit their Beneficial Ownership Information (BOI) reports, including any updates or corrections to prior reports.

Six-Month Extension Criteria:

If your original filing deadline (for initial or updated BOI report) falls within the following periods, you may be eligible:

• Hurricane Milton: Deadline between 10/04/24 and 01/02/25

• Hurricane Helene: Deadline between 09/22/24 and 12/21/24

• Hurricane Francine: Deadline between 09/08/24 and 12/07/24

• Hurricane Debby: Deadline between 07/31/24 and 10/29/24

• Hurricane Beryl: Deadline between 07/04/24 and 10/02/24

To qualify, businesses must:

• Be located in a FEMA-designated area eligible for individual or public assistance.

• Have an IRS designation for tax relief eligibility in the impacted area.

August 30, 2024 - Labor Day

Our offices will be closed on Monday, September 2nd. We will re-open on Tuesday, September 3rd at 8:30 AM EST. Wishing you a fantastic and safe Labor Day!

July 8, 2024 - FinCEN BOI Reporting: Obligations for Dissolved EntitiesThe U.S. Treasury Department's Financial Crimes Enforcement Network (FinCEN) issued an update regarding entities that no longer exist. Per the FAQ update, if a reporting company created or registered in 2024 or later ceases to exist before its initial BOI report is due to FinCEN, it must still submit the report. Companies created or registered in 2024 have 90 days to report their beneficial ownership information, while those created or registered in 2025 or later have 30 days. These requirements apply even if the company is dissolved before the initial report is due. However, if the company ceases to exist after submitting the initial report, no additional report is required.

July 1, 2024 - Independence DayOur offices will be closed on Thursday, July 4th, but we'll be back and ready to assist you on Friday, July 5th at 8:30 AM EST. Wishing you all a safe and happy Independence Day!

January 29, 2024 - FinCEN Agency Information Collection ActivitiesAn invitation is scheduled to be published on 1/30/2024 in the Federal Register for all interested parties to comment on the proposed information collection associated with requests made to The Financial Crimes Enforcement Network (FinCEN), for beneficial ownership information, consistent with the requirements of the Beneficial Ownership Information Access and Safeguards final rule. The complete document: Financial Crimes Enforcement Network Agency Information Collection Activities; Proposed Collection; Comment Request; Beneficial Ownership Information Requests

December 20, 2023 - Happy HolidaysURS will be closed on Monday, December 25th. We will re-open on Tuesday, December 26th, 2023 at 8:30 a.m. EST should you have any year-end service needs.

We will be closed on Monday, January 1st, 2024 as we celebrate the New Year. We will re-open on Tuesday, January 2nd, 2024 at 8:30 a.m. EST.

In response to the necessity for increased awareness and education surrounding CTA reporting mandates, FinCEN has announced a decision to extend reporting deadlines for entities established in 2024.

1. 90 day window to file the initial report for entries formed on or after 1/1/24 and on or before 12/31/24.

2. Amendments to any initial filing done in 2024 or prior remain due within 30 days of the change to information in your filing. This did not change.

3. For entities registering on or after 1/1/25, the initial filing is due within 30 days. Any amendments to the initial filing will remain due in 30 days.

URS Compliance will be closed on Thursday, November 23, 2023 and Friday, November 24, 2023 in observance of the Thanksgiving holiday. We will re-open on Monday, November 27, 2023 at 8:30 a.m. ET.

November 1, 2023 - Corporate Transparency Act Scam AlertThe U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) posted an alert of recent fraudulent attempts to solicit information from individuals and entities who may be subject to reporting requirements under the Corporate Transparency Act (CTA). The fraudulent e-mails and letters may be titled "Important Compliance Notice" and asks the recipient to click on a URL or to scan a QR code. As FinCEN does not send unsolicited requests, do not respond to these fraudulent messages, or click on any links or scan any QR codes within them.

October 3, 2023 - Remarks of FinCEN Director Andrea GackiAndrea Gacki, FinCEN's new Director since September, has prioritized discussing the Corporate Transparency Act (CTA) and Beneficial Ownership Information (BOI) reporting. She emphasizes their crucial role in boosting financial transparency and combating illicit activities, aligning with FinCEN's mission to promote integrity and accountability in the financial sector for national security and system stability. Prepared Remarks of FinCEN Director Andrea Gacki at the The Assembly, a meeting of ACAMS (Association of Certified Anti-Laundering Specialists)

September 27, 2023 - FinCEN released an update concerning BOI reporting deadlines.The proposed ruling would provide entities formed in 2024 with 90 days in which to complete BOI reporting (as opposed to the original requirement of 30 days). The timeframe would then narrow to 30 days for entities formed on or after 01/01/2025. As a note, no change is proposed for the deadline for entities formed in 2023 and prior. These entities will have 1 year (beginning on 01/01/2024) to complete BOI reporting. More information: FinCEN issues a Notice of Proposed Rulemaking to extend the deadline for certain companies to file their beneficial ownership information reports

September 18, 2023 - FinCEN Issues Compliance Guide to Help Small Businesses Report Beneficial Ownership InformationThe U.S. Department of the Treasury’s Financial Crimes Enforcement Network released the FinCEN Small Entity Compliance Guide to aid small businesses in meeting the new 2024 requirement to report information about their beneficial owners to FinCEN. The guide helps businesses determine if they need to report this information. FinCen Small Entity Compliance Guide. More information: FinCEN Issues Compliance Guide to Help Small Businesses Report Beneficial Ownership Information.

September 1, 2023 - Labor DayOur offices will be closed on Monday, September 4th. We will re-open on Tuesday, September 5th at 8:30 EST. Have a wonderful and safe Labor Day celebration!

July 3, 2023 - Montana 2024 Annual Report FeesMontana will be waiving their 2024 annual report fees for all businesses that file their annual reports between January 1, 2024 and April 15, 2024 (deadline for annual report filings). The annual report needs to be filed, but the fees will be waived. Any prior year annual report fees and the reinstatement fee will not be waived.

June 28, 2023 - Independence DayOur offices will be closed on Monday, July 4th. We will re-open on Tuesday, July 5th at 8:30 EST. Wishing you all a safe and happy Independence Day!

June 1, 2023 - Mississippi New Audit Requirement ThresholdEffective July 1, 2023, the new audit requirement threshold for charitable solicitation registrations in Mississippi has increased to $750,000 in monetary contributions. The previous threshold was $500,000. Senate Bill 2077, which passed in March, brought this welcome change. However, the law contains an obscure reference to requiring a cash basis measurement only in the title of the legislation, no such requirement appears in the text of the law. A cash basis measurement requirement would directly conflict with the vast majority of states' laws that require conformance with GAAP.

May 2, 2023 - Warning from the Office of the Tennessee Secretary of StateThe Secretary of State's office has been made aware of an email targeting businesses that have failed to file their annual report. The email is from a company that goes by Registrar Agency of Corporations.

The organization sending these emails is not affiliated with the Tennessee Secretary of State in any way. It is not authorized to file any documents nor accept any payments on behalf of the Secretary of State.

The email's subject line includes the company name and "Expired: Set for Dissolution" and claims Tennessee businesses must file additional requirements and pay a fee of $99.98 to correct the Inactive Status.

Businesses that still need to file their 2023 annual report can do so by filing directly with the no extra fee at Tennessee Division of Business and Charitable Organizations.

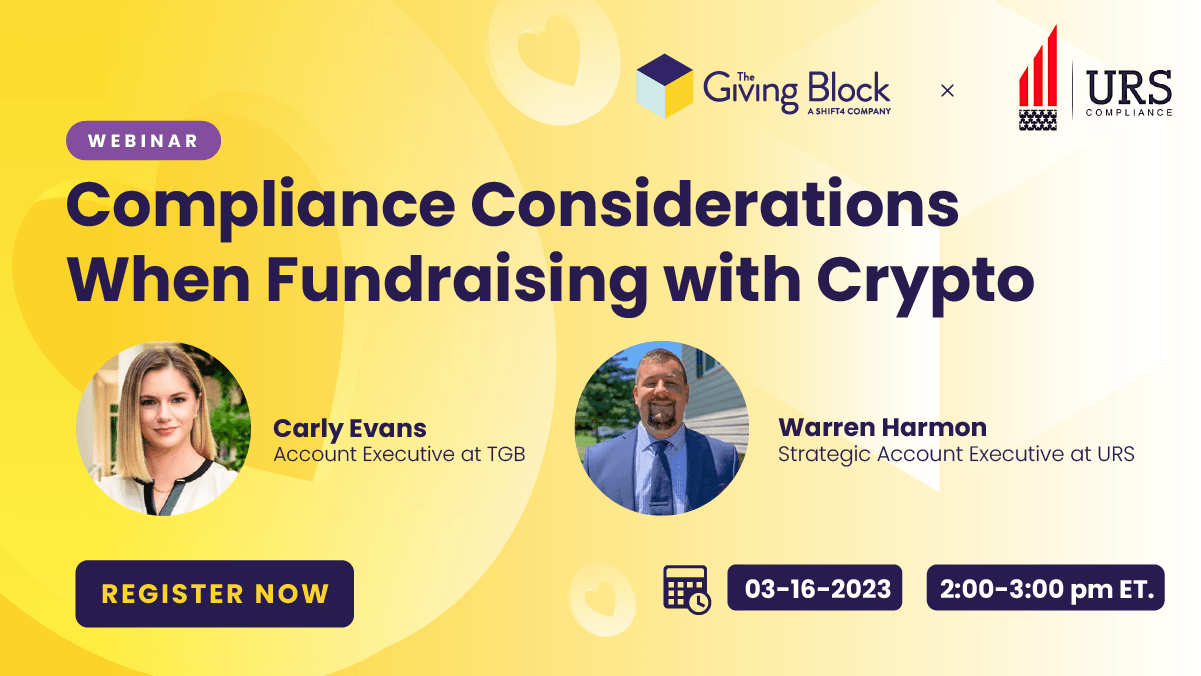

Feb 1, 2023 - Compliance Considerations When Fundraising with Crypto WebinarDon't miss out on the opportunity to learn about compliance considerations when fundraising with crypto. Register now to join Warren Harmon with URS Compliance and The Giving Block on March 16th at 2:00 pm EST

January 16, 2023 - Tennessee Charity and Business Filing System

January 16, 2023 - Tennessee Charity and Business Filing System

Tennessee has transitioned to online filings for state charitable solicitation registrations. The Tennessee Charity and Business Filing System offers the ability to track filings, receive completed documents, submit corrections, upload attachments, and pay online. The online filing requirement became mandatory at the end of 2022, and as of December 2022, the state started returning paper-filed registrations and renewals.

December 20, 2022 - Happy HolidaysURS will be closed on Monday, December 26th. We will re-open on Tuesday, December 27th, 2022 at 8:30 a.m. EST should you have any year-end service needs.

We will be closed on Monday, January 2nd, 2023 as we celebrate the New Year and will re-open on Tuesday, January 3rd, 2023 at 8:30 a.m. EST.

URS will be closed on Thursday, November 24, 2022 and Friday, November 25, 2022 in observance of the Thanksgiving holiday. We will re-open on Monday, November 28, 2022 at 8:30 a.m. ET.

July 7, 2022 - California State Fee ChangesIn response to the State of California budgetary surplus, fees have been reduced for new/initial filings for the period of one year to encourage new business formations within the State. Although the funding comes from California's recent budgetary bill (SB 154), this is a temporary administrative pricing change.

Processing fees for new (domestic and foreign) Corporations, LLCs, and LPs will be $0 (no charge) through June 30th, 2023. All other fees (non-initial filing fees, counter fees, expedite fees, and certified copy fees) remain unchanged.

Our offices will be closed on Monday, July 4th. We will re-open on Tuesday, July 5th at 8:30 EST. Wishing you all a safe and happy Independence Day!

June 15, 2022 - Juneteenth State Office ClosuresThe following State offices will be closed Friday, June 17, 2022 or Monday, June 20, 2022 in observance of Juneteenth:

June 17, 2022

• Louisiana

• New Jersey

• West Virginia

June 20, 2022

• Alabama

• Colorado

• DC

• Delaware

• Georgia

• Idaho

• Illinois

• Maine

• Maryland

• Michigan

• Minnesota

• Missouri

• Nebraska

• New Mexico

• New York

• Ohio

• Oregon

• Pennsylvania

• South Dakota

• Utah

• Virginia

• Washington

• West Virginia (closed for West Virginia Day)

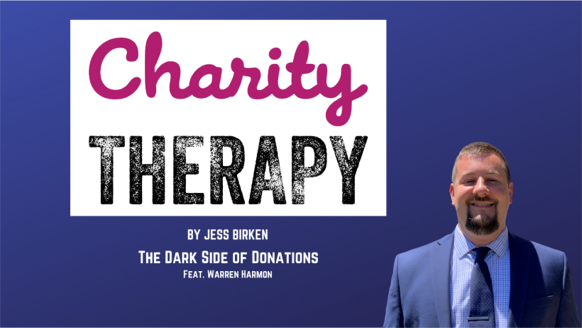

Catch Warren Harmon of URS Compliance on this week’s episode @JessBirken’s podcast #CharityTherapy! Jess had Warren on to talk all about how to navigate the world of fundraising compliance. You won’t want to miss it! Check out The Dark Side of Donations.

May 23, 2022 - Memorial Day

May 23, 2022 - Memorial Day

URS Compliance Services will be closed on Monday, May 30, 2022 in observance of Memorial Day. We will re-open on Tuesday, May 31, 2022 at 8:30 a.m. ET.

February 4, 2022 - Secretary of State ClosuresDue to inclement weather, the following Secretary of State offices are closed for today.

Kentucky - Over-the-counter submissions will resume when the State re-opens.

Maine - Over-the-counter submissions will resume when the State re-opens.

Ohio - Over-the-counter submissions will resume when the State re-opens.

Oklahoma - Over-the-counter submissions will resume when the State re-opens.

Texas - SOSDirect will be available for document searches. SOSDirect and SOSUpload will be available for electronic filing during this time.

Due to inclement weather, the following Secretary of State offices are closed for today.

Colorado - Corporate on-demand orders will be processed remotely and eligible on-line requests will be submitted. Over-the-counter submissions will resume when the State re-opens.

Indiana - Corporate on-demand orders will be processed remotely and eligible on-line requests will be submitted. Over-the-counter submissions will resume when the State re-opens.

Kansas - Corporate on-demand orders will be processed remotely and eligible on-line requests will be submitted. Over-the-counter submissions will resume when the State re-opens.

Michigan - Corporate on-demand orders will be processed remotely and eligible on-line requests will be submitted. Over-the-counter submissions will resume when the State re-opens.

New Mexico - Corporate on-demand orders will be processed remotely and eligible on-line requests will be submitted. Over-the-counter submissions will resume when the State re-opens.

The Illinois Secretary of State will continue their office closure due to an increase in COVID metrics until Monday, January 24th. They are accepting filings via UPS. Expedited service requests are currently suspended until the re-opening of the State office. All filings will be submitted routine at this time. The Illinois Secretary of State will be sporadically returning evidence (delays should be expected).

January 3, 2022 - Secretary of State ClosuresDue to the inclement weather, the State of Delaware, Division of Corporations office will be closed Monday, January 3, 2022.

An Extraordinary Event will be logged in the system which will permit file dates on the day the State is closed (Extraordinary Event does not apply to UCC filings). Document upload will not be available.

Additionally, the following Secretary of State offices are closed today:

• US Department of State (District of Columbia is currently open)

• Maryland

• Virginia

URS Compliance Services will be closed on Friday, December 24th. We will re-open on Monday, December 27th, 2021 at 8:30 a.m. EST should you have any year-end service needs. Also, we will be closed on Friday, December 31st, 2021 as we celebrate the New Year. We will re-open on Monday, January 3rd, 2022 at 8:30 a.m. EST.

November 23, 2021 - ThanksgivingURS Compliance Services will be closed on Thursday, November 25, 2021 and Friday, November 26, 2021 in observance of the Thanksgiving holiday. We will re-open on Monday, November 29, 2021 at 8:30 a.m. ET.

November 10, 2021 - Veterans DayAll Federal and all state offices (excluding Wisconsin) will be closed on Thursday, November 11th in observance of Veterans Day. URS Compliance will be open for all of your service needs. Our Delaware office will be partially open for certificates & UCC only (no filings) until 5:00 pm EST.

September 3, 2021 - North Carolina Delinquency Notices Sent in ErrorA North Carolina Secretary of State technical error occurred on September 1, 2021 resulting in some limited liability companies (LLCs) having their status changed from Current/Active to Active - Not Current. Emails were sent out notifying people that their Annual Reports were delinquent when they were not. This issue has been resolved and all statuses have been updated to reflect the correct status of the company. For more information visit North Carolina Secretary of State.

July 1, 2021 - Schedule BThe U.S. Supreme Court held that California Attorney General’s requirement that nonprofits disclose certain donors is unconstitutional (AMERICANS FOR PROSPERITY FOUNDATION v. BONTA, ATTORNEY GENERAL OF CALIFORNIA). The Registry of Charitable Trusts will no longer require the filing of Schedule B to the IRS Form 990 as part of its registration and annual reporting requirements.

June 18, 2021 - JuneteenthThe following State Offices will be closed Friday, June 18, 2021 in observance of Juneteenth: • Alabama • Delaware (Corporate documents cannot be submitted for filing on June 18th. Services available on 6/18 are Good Standings, Certified or Plain Copies, UCC Searches.) • Idaho • Illinois • Louisiana – closing at 12 pm CST • Maryland • Missouri • Nebraska • New Jersey • Ohio • Pennsylvania • Virginia • West Virginia • Washington DC

May 24, 2021 - Memorial DayURS Compliance Services will be closed on Monday, May 31, 2021 in observance of Memorial Day. We will re-open on Tuesday, June 1, 2021 at 8:30 a.m. ET.

November 23, 2020 - ThanksgivingURS Compliance Services will be closed on Thursday, November 26, 2020 and Friday, November 27, 2020 in observance of the Thanksgiving holiday. We will re-open on Monday, November 30, 2020 at 8:30 a.m. ET.

November 9, 2020 - Veterans DayAll Federal and all state offices (excluding Wisconsin) will be closed on Wednesday, November 11th in observance of Veterans Day. URS Compliance Services will be open for all your service needs. Please note our Delaware office will be available to complete document and UCC retrieval requests 10:00 am to 4:00 pm EST.

October 28, 2020 - Delaware Secretary of State ClosureIn observance of Election Day, the Delaware Secretary of State will be closed Tuesday, November 3rd, 2020.

Corporate

• You will NOT be able to obtain the file date of November 3rd, 2020 unless prior arrangements have been made.

• November 3rd, 2020 can be used as a future effective date.

• Filing evidence will not be received on November 3rd.

• Good Standings, Cert Res, Certified Copies, and Plain Copies are available as usual.

• Ability to reserve names, pay franchise tax, and obtain blank annual reports will not be affected by the closure.

UCC

• UCC Filings CANNOT obtain the November 3rd file date UNLESS they are filed via XML.

• Filing evidence will NOT be received on November 3rd.

• UCC Searches, document retrievals, corporate plain/certified copies, and good standings will not be affected by the closure and will be processed throughout the day.

• XML and WEB filing will be available as usual.

Also, the following States will be closed on Election Day:

Hawaii

Indiana

Illinois

Kentucky

Maryland

Michigan

Montana

New Jersey

New York

Rhode Island

West Virginia

The following are the States that will be closed tomorrow June 19, 2020 in observance of Juneteenth:

Texas - Closed tomorrow

Pennsylvania - Closed tomorrow

New York - Closed tomorrow

Virginia - Closed tomorrow

Delaware - Closed tomorrow

Also, West Virginia will be closed for West Virginia Day.

Delaware 2019 LLC, LP and GP taxes are due on or before June 1, 2020. If taxes are not paid by June 1, a penalty is assessed, and interest will accrue. Also, your company will no longer be in good standing.

In addition, Delaware 1st quarter taxes for Corporations are due on or before June 1, 2020.

In response to COVID-19, Administrative Order 2020-02 was set in place on April 13, 2020. All Puerto Rico annual registrations and filing fees for FYE 2019 will now be due on or before July 15, 2020.

April 1, 2020 - Charitable Solicitation Registration renewals are due on May 15thCharitable Solicitation Registration renewals are due on May 15th, if your 990 will not be available please obtain an automatic extension of time to file the return with the IRS (form 8868) for organizations using the calendar-year as its tax year.

Delaware 2018 LLC, LP and GP taxes are due on or before June 1, 2019. If taxes are not paid by June 1, a penalty is assessed, and interest will accrue. Also, your company will no longer be in good standing.

In addition, Delaware 1st quarter taxes for Corporations are due on or before June 1, 2019.

Charitable Solicitation Registration renewals are due on May 15th, if your 990 will not be available please obtain an automatic extension of time to file the return with the IRS (form 8868) for organizations using the calendar-year as its tax year.

To obtain an extension with Mississippi for your renewal it must be requested on the 14th of May not the 15th.

Please be advised that for Fiscal Year End 12/31/2017, with a due date of 6/30/2018, you will be given until an additional 60 days(until August 31, 2018) to file an extension.

March 21, 2018 - URS Compliance Completes Acquisition of Simple Charity Registration:Simple and Affordable Solution for Nonprofit Organizations to Comply with State Registration Requirements. Learn more at:https://www.prweb.com/releases/urs_compliance_completes_acquisition_of_simple_charity_registration/prweb15324583.htm

December 27, 2017 - From the Connecticut Secretary of State:Effective January 1, 2018, all annual reports for Domestic and Foreign Limited Liability Companies will be due between January 1st and March 31.

December 20, 2017 - A new law was announced by the Illinois Secretary of State, Jesse White,to reduce filing fees for LLC’s this is taking effect immediately. The new fees are listed below.

Articles of Organization .........................$150

Application for Admission ..................... $150

Restated Articles ................................... $150

Articles of Organization -Series ............. $400

Application for Admission- Series ......... $400

Articles of Amendment ......................... $50

Amendment Application ....................... $50

Application of Withdrawal .................... $5

Name Reservation ................................. $25

Cancel Name Reservation ...................... $5

Transfer Name Registration ................... $25

Name Reservation Application .............. $50

Registered Name Renewal ..................... $50

Assumed Name - Change ....................... $25

Assumed Name - Cancel ........................ $5

Annual Report ........................................ $75

Reinstatement Application ..................... $200

Petition for Refund ................................. $5

Resignation of Registered Agent ............ $5

Affidavit of Compliance .......................... $5

Statement of Termination ...................... $5

Cancellation of Registered Agent ........... $5

Application of Withdrawal - Foreign ...... $5

A waiver of penalties resulting from the late filing of annual reports or payment of annual fees for 2016 has been granted by the Secretary of State through an Administrative Order. Non-profit entities that request the waiver will pay double the annual fees owed. For-profit entities will pay triple the annual fees owed. See Art. 22.08 of the Corporations Act.

This waiver will expire on February 8, 2018. For more information, call 787-722-2121, extensions 4402, 4403, and 4404.

A reminder that the State's charitable fundraising law was recently amended to remove fundraising counsel from its provisions. As of July1, 2017, fundraising counsel no longer needs to register with the Secretary of State of Tennessee.

August 30, 2017 - News from the Montana Secretary of StateThe Montana Secretary of State's Office is going completely digital. Paper forms will no longer be accepted beginning September 1, 2017. All Business Filings and Annual Reports must be submitted online via ePass Montana.

May 4, 2017 - TennesseeEffective July 1st, fundraising consultants will not have to register with the Division of Charitable Solicitations in the Office of the Tennessee Secretary of State. In addition, there is also a provision in the new law that deletes the requirement of disclosing the bank account information on a solicitor's campaign notice.

November 01, 2016 - December Holiday State Office Closings.*Please note,these dates are subject to change at the state's discretion.

| Date | States Closed |

|---|---|

| 12/23 –Christmas Eve (observed) | AR, IL, KY, LA, MI, MS, NC, OK, SC, TN, TX, VA, WI, WV |

| 12/26 – Christmas Day (observed) | |

| 12/27–Day following Christmas | AL, FL, GA, KS, KY, LA, ME, OK, NC, NM, SC, SD, TN, TX, VA, WY |

| 12/30–New Year’s Eve (observed) | KY, LA, MI, MS, TN, TX (Comptroller Only), WI, WV, WY |

*Please note,these dates are subject to change at the state's discretion.

| Date | States Closed |

|---|---|

| 11/8 – Election Day | DE, HI, IL, IN, MD, MI, MT, NJ, NY, RI, WV |

| 11/11 – Veterans Day | All States |

| 11/24 – Thanksgiving Day | All States |

| 11/25 – Day after Thanksgiving | AL, CA, CO, DE, FL, GA, IA, IL, IN, KS, KY, MD, ME, MI, MN, MS, NE, NH, NC, NM, NV, OK, OR, PA, SC, TN, TX, VT, VA, WA, WV |

Beginning August 10, 2016, paid solicitors who register or renew their registration with the Colorado Secretary of State will need to attach evidence of a $15,000 surety bond with their filings. They will also need to disclose whether any of their officers, directors, or employees serve on the board of directors of a charitable organization, direct the operations of a charitable organization, or otherwise have a financial interest in a charitable organization for which the applicant solicits contributions. These are changes in law resulting from the passage of House Bill 16-1129 during the 2016 General Assembly.

Additional changed included in HB 16-1129 and questions on this new requirement can be directed to the Colorado Secretary of State's Charities Program at charitable@sos.state.co.us

The Commerce Tax is an annual tax passed by the Nevada Legislature during the 2015 Legislative Session. All business entities engaged in business in Nevada are required to file the Commerce Tax return, regardless of whether there is a tax due or not. The tax is imposed on businesses with a Nevada gross revenue exceeding $4,000,000 in the taxable year. This year, the first return is due August 15, 2016.

July 25, 2016 - News From the Wyoming Secretary of StateCHEYENNE, WY - Wyoming Secretary of State Ed Murray is excited to announce the launch of new electronic business filing services never before possible at the Secretary of State's Office.

These new online services will allow for the electronic filing of documents that were previously only paper based. "Our goal in the Wyoming Secretary of State's Office is to be business friendly and operate at the fast paced and dynamic speed of business, not government," stated Secretary Murray.

The Secretary of State's Business Division has recently launched online business filing tools for the formation of Limited Liability Companies, Profit Corporations, and Nonprofit Corporations. In addition, any registered business entity in good standing may generate an electronic "Certificate of Good Standing" at no cost.

All public business documents are now searchable online and immediately available for viewing by anyone on the Secretary of State's website as part of this launch.

To access these online services for businesses, visit: https://wyobiz.wyo.gov/Business/Default.aspx.

Limited Partnerships, Limited Liability Companies, and General Partnerships formed in Delaware are required to pay their Annual Tax on or before June 1. The penalty for non-payment or late payment is $200. Interest will accrue on the tax and the penalty at the rate of 1.5% per month.

May 09, 2016 - Georgia Secretary of State Warns of ScamATLANTA, GEORGIA - Secretary of State Brian Kemp alerts Georgia businesses to ignore scam mail from a sham entity which calls itself the "Business Compliance Division." The office has received complaints about the entity, which mails postcards to companies falsely warning the company about a "potential compliance violation."

"The Business Compliance Division is a bogus company soliciting Georgia businesses to scare people into paying potentially hundreds of dollars in unnecessary fees," stated Secretary Kemp. "I am advising anyone who receives mail from this company to ignore it."

The card warns business owners to "call immediately" to "avoid potential fees and penalties." Once a caller speaks to an alleged company representative, they are scammed into ordering a copy of their business' Certificate of Existence to ensure they are in compliance. The representative will then request a credit card number and charge the caller upwards of $125 to order the certificate.

Other states have issued similar warnings to businesses about the scam.

"If anyone wants to order a valid Certificate of Existence, it only costs $10 to order it through the Secretary of State's Corporations Division," said Kemp. "Do not be fooled into giving your personal credit card information to an unknown, sham entity such as the Business Compliance Division."

To obtain a legitimate copy of your Certificate of Existence in Georgia, request the form on the eCorp website or call the Corporations Division at (404) 656-2817

Atlanta - Georgia Secretary of State Brian Kemp reminds officers and registered agents of corporate entities registered in Georgia that the annual registration renewal period has begun. The deadline for the annual registration renewal period is 11:59 p.m. on Wednesday, April 1, 2015. Georgia law requires all corporations, limited liability companies and limited partnerships to file annual registrations with the Secretary of State and pay the renewal fee. Business entities that fail to renew by the deadline will be charged a $25 late filing penalty fee and risk being administratively dissolved.

November 16, 2015 - From the Delaware Division of Corporations: UCC Paper Filing ChangeEffective December 1, 2015, the Delaware Division of Corporations will modify the acceptable methods of communication authorized by the filing office for the acceptance of Uniform Commercial Code (UCC) filings. The Division will require that all UCC filings be submitted to the Division electronically. The filing office will no longer accept paper UCC filings submitted directly to the State via mail, courier or fax. Electronic UCC filings may be submitted directly to the Division via the State's e-UCC web application or through a variety of UCC XML submitters. Paper filings may be submitted through an Authorized UCC Filer who will submit the filing electronically to the Division.

October 12, 2015 - From the Colorado Secretary of StateDENVER, Oct. 9, 2015 -- Colorado on Oct. 20 will become the first state in the country to offer all business certification services online.

Customers currently pay to receive certification, either by mailing the Colorado Secretary of State's Office or visiting it in person. Effective Oct. 20, online services will be free.

Certificates of Good Standing already were available online, but the following certificates will also be available free on the secretary of state website:

- Certificate of Documents Filed: provides certified copies of all documents relating to an entity or record in the secretary of state's database.

- Certificate of Document Filed: provides a certified copy of an individual document filed in the secretary of state’s records.

- Certificate of Fact of Trade Name: certifies that a statement of trade name for a specific name was filed with the secretary of state’s office and its effective date.

- Certificate of Fact of Existence: certifies that a constituent-filed document for a non-reporting entity was filed and that no dissolution document has been filed for that entity.

Each certificate will contain a unique confirmation number that can be validated on our website. In addition, each record’s history can be displayed in a print-friendly version.

Once this system is launched, the Colorado Secretary of State office will no longer issue certificates or certified copies in person or by mail. The new online certificates will be accessible via the Secretary of State’s Business Organizations pages.

October 1, 2015 - 2017 Form 990 (series) Calendar Year Filers Extension ChangesFor 2016 Forms 990 (those with tax years beginning January 1, 2016 and after). Under this Act cited as Surface :

Transportation and Veterans Health Care Choice Improvement Act of 2015'', which was recently signed into law by President Obama July 31, 2015. A calendar year filer of any Form 990 (series) return shall request an automatic extension of its Form 990 deadline to November 15th. The automatic 6-month extension is only available for Forms 990 to be filed in 2017 and years after.

114-41 Page 129 STAT. 458 (b) (4):

The maximum extension for the returns of organizations exempt from income tax filing Form 990 (series) shall be an automatic 6-month period ending on November 15 for calendar year filers.

Beginning July 1, 2015: Limited Liability Company (LLC, PLC, & L3C) Annual Reports will be due during the 3 month period following the Fiscal Year End on record. (as per H.310 (Act 17))

For LLC's with a fiscal year end of 7/31/15, Annual Reports will be due on or before 10/31/15.

September 10, 2015 - Modified hoursThe Delaware Division of Corporations will be operating under the following modified hours following their recent system upgrade.

September 8 through September 11 - 8AM to 5PM. All 1 hour, 2 hour and same day submissions must be received by 1PM. 24 hour and all other submissions are due by 5PM.

September 14 through September 18 - 8AM to 8PM. All 1 hour and 2 hour submissions must be received by 5PM. All other expedited cut-off times will return to normal (same day 2PM and 24 hour 7PM) and all other submissions are due by 8PM.

June 17, 2015 - IMPORTANT NOTICE OF FEE INCREASE FROM NEVADA SECRETARY OF STATEAs the agency in charge of collecting business license fees, Secretary of State Barbara Cegavske's office is prepared to assist in implementing the changes outlined in Senate Bill 483 and to help new and existing Nevada businesses during the transition period. Effective July 1, 2015, the Secretary of State's office will implement the following fee increases to business filings, as stipulated under SB 483:

Any Annual or Initial List or State Business License application due by the end of August, 2015 or earlier, received prior to July 1, 2015 will be assessed the pre-July fees.

- The annual State Business License fee for corporations formed pursuant to Chapters 78, 78A, 78B, and 80 will increase to $500, from $200.

- The business license fee for all other entity types remains $200 per year.

- The fee for Initial and Annual Lists will increase by $25 for all entity types.

The fees for Annual or Initial Lists or State Business License applications, reinstatements and revivals received after July 1, 2015 will be calculated based on the new fees, even if for prior years.

Additionally, as of July 1, 2015, the State Business License will be referred to as the State Business Registration.

Questions should be directed to the Secretary of State's customer service division by calling (800) 450-8594.

Any questions regarding the Commerce Tax should be referred to the Nevada Department of Taxation at (866) 962-3707.

April 01, 2015 - April Holiday State Office Closings*Please note,these dates are subject to change at the state's discretion.

| Date | States Closed |

|---|---|

| 4/3 - Good Friday | CT, DE, HI, IN, LA, NJ, NC, ND, TN, TX |

| 4/16 - DC Emancipation Day | DC |

| 4/20 - Patriot's Day | ME, MA |

| 4/24 - Arbor Day | NE |

| 4/27 - Confederate Memorial Day | AL, GA, MS |

DENVER, March 24, 2015 — Secretary of State Wayne Williams announced a new e-filing initiative to support Colorado′s charitable gaming community. For the first time, the bingo-raffle program of the Colorado Department of State will accept electronic filing. Starting immediately, licensees can submit and pay for quarterly report filings online. ″This is just the latest initiative by my office to make compliance simpler for Colorado′s charitable community,″ Williams remarked. ″Electronic filing will save time and money for Colorado′s bingo-raffle operators, providing more money for Colorado charities.″ Electronic filing reduces the time necessary to submit and process required forms. It will also streamline the communications process between the Department of State and bingo‐raffle licensees. Filing fees will be reduced for licensees who file online, and e-filing will save them up to 10% on their quarterly filing fees.

″The e‐filing system was easy to access and use,″ said Christine Krueger, one of the individuals who tested the new system. ″It will save our group time in preparing and submitting the quarterly, and we do not have the costs of paper, ink, stamps and time.

March 19, 2015 - MISSISSIPPI LEGISLATIVE UPDATEMississippi Uniform Limited Partnership Act — The Mississippi Uniform Limited Partnership Act updates and modernizes limited partnership law in Mississippi. The current laws are based on the Revised Uniform Limited Partnership Act (RULPA 1978/1985) and were adopted in 1987. These updates would provide clearer protection for limited partners, perpetual duration for limited partnerships, expanded purposes for limited partnerships (allowing asset protection and estate planning type measures), and the formation of Limited Liability Limited Partnerships (LLLP). SB 2310 (sponsored by Sen. Sean Tindell) passed the Senate and the House. The bill is currently on its way to the Governor. The House version of this bill was sponsored by Rep. Trey Lamar.

March 05, 2015 - MontanaEffective Feb. 18, 2015, Senate Bill 35 eliminates the Certificate of Existence requirement for out of state businesses. Instead, a statement is required that the entity exists and complies with the organizational laws in their domestic state. Read complete bill below.

http://leg.mt.gov/bills/2015/sesslaws/ch0042.pdf February 12, 2015 - Arkansas Secretary of State announces that 2015 Franchise Tax forms are available for filing online.All franchise taxes must be filed online or postmarked by May 1, 2015.

NOTE: Revoked entities continue to accrue franchise taxes annually until the business is dissolved or withdrawn with the Business & Commercial Services Division.

23 Jan 2015 - Kansas Secretary of State Unveils New Fraud Notification System for Business Filers A new service was recently deployed by the Kansas Secretary of State that automatically sends an email notification to business owners informing them of any amendments related to their business entity registered with the Kansas Secretary of State.

January 16, 2015 - Office Closures:Our office will be closed on Monday, January 19th, 2015 in observance of Martin Luther King, Jr. day. We will re-open on Tuesday, January 20th, 2015 at 8:30 a.m. est.

As a reminder, all Secretary of State Offices will be closed on January 19, 2015.

January 14, 2015 - Nebraska Secretary of State Encourages Online Filing of Annual ReportSecretary of State John Gale stresses the importance of filing annual reports on time and the ease of online filing. ″Maintaining good standing with the state is the gold standard for business entities. Without good standing, a business will likely lose its limited liability and its creditworthiness unless immediately reinstated.″

Gale added that online filing reduces the risk of having paper forms lost or misplaced. ″Filing paper forms is a thing of the past.″

January 07, 2015 - From the Secretary of the Commonwealth of Massachusetts:As of January 1, 2015, the Corporations Division will no longer accept an FEIN number in conjunction with the organization, formation or registration of any new business entity filing. If an FEIN number is included on a new business entity filing it will be redacted and a nine digit state ID number assigned.

December 31, 2014 - January State Office Closings.| Date | States Closed |

|---|---|

| 1/1/15 ‐ New Year′s Day | All States |

| 1/2/15 ‐ Day after New Year′s | KY, LA, MS, VA |

| 1/16/15 ‐ Lee-Jackson Day | VA |

| 1/19/15 ‐ Martin Luther King, Jr. Day | ALL |

| 1/20/15 ‐ Governor Inauguration | PA |

| Date | States Closed |

|---|---|

| 12/24 | AR, IL, LA, MI, MS, NC, OK, SC, TN,TX, WI, WV |

| MD - Service Reduction | |

| 12/25 | ALL |

| 12/26 | GA, IN, AL, KS, KY, LA, NC, SC, SD,TX, VA, WY |

| 12/30 | TX (Comptroller Only) |

| 12/31 | LA, MI, TN, TX (Comptroller Only), WIWV, WY, MD - Service Reduction Day |

As of January 1, 2015, non-voting ex officio board members are prohibited. Here's what you need to know.

A little-noticed change in the California Nonprofit Corporations Code has an important change for nonprofits: there can no longer be non-voting members of the board of directors. Attorney and CalNonprofits volunteer Gene Takagi explains:

A revision of the Nonprofit Corporations Code takes effect on January 1, 2015 and clarifies the term ex officio and the principles of voting nonprofit board members. A little background:

Non-voting board members: It′ not uncommon for nonprofits to provide in their bylaws for non-voting board members, but under California law, such positions do not exist. Board members, or directors, as they are termed in the law, each have one vote on any matter presented to the board for action. So, any person entitled to attend board meetings without a vote is not a board member at all, even if your bylaws specify so.

What ex officio really meansEx officio: The term ex officio is often misused to mean non-voting, but it actually means "by virtue of one′s office." An ex officio director holds office as a director not by election, but by holding another office that gives her the right to be a director for so long as she holds that other office. For example, an executive director who is also an ex officio director is a board member for as long as she remains the executive director. In some cases a public official — such as the mayor or the city librarian -- may be an ex officio member of a nonprofit board. Some nonprofits give ex officio, non-voting status to founders or former board members.

The new law explicitly states that "[a] person who does not have authority to vote as a member of the governing body of the corporation, is not a director — regardless of title." The revision also effectively provides that a person with the designation of ex officio director in the articles or bylaws shall have all the rights and obligations, including voting rights, of a director unless the articles or bylaws limit that person′s right to vote as a director.

In other words, if you have ex officio, non-voting members of your board, they now have the right to vote on all matters unless you change their status.

California nonprofit corporations that do not intend to empower their ex officio directors with all the rights of a director must make sure their articles and bylaws contain the appropriate limiting language or, better still, eliminate the use of the terms ex officio director and nonvoting director. Getting this wrong may result in a costly dispute or unintentionally empower an individual as a director when the board had no intention of providing the individual with such authority.

Simple language changesFor those nonprofits that want to provide for the right of their executive directors to attend board meetings without the voting power of a director, instead of using the misnomer non-voting ex officio director to describe such arrangement, they might use the following description: "The executive director has the right to attend and participate at all meetings of the board, except when the board enters executive session, but shall have no voting powers.″ Nonprofits that have created ex officio, non-voting board members for founders, public officials or others, may consider changing their status to honorary board member, with no voting powers.

November 15, 2014 - Pennsylvania Bureau Changes Due Dates For Renewing Charitable Solicitation RegistrationsOn October 14, 2014, Governor Corbett signed H.B. No. 359 into law, changing the due dates for certain fundraising registrations required under Pennsylvania law. These changes take effect 60 days after the signing. Most organizations that solicit contributions for charitable purposes in Pennsylvania, and consultants to those organizations, must register with the Pennsylvania Bureau of Corporations and Charitable Organizations (the "Bureau"). These registration requirements are established under the Pennsylvania Solicitation of Funds for Charitable Purposes Act. As is the case in most states, the required filings include both an initial registration statement as well as ongoing annual renewal registration statements.

The recent — and welcome — legislative amendments make the due dates for filing annual registration statements with the Bureau consistent with the due dates for filing Form 990 Returns with the IRS. This should be helpful to many charities that rely heavily on the financial information reported on their Form 990 Returns to prepare and file their annual charitable solicitation registrations.

The discrepancy between the filing deadlines occurs because of a difference between state and federal law. Under current Pennsylvania law, a charity is generally required to file its annual state registration with the Bureau within 135 days of the end of its fiscal year. It is not, however, required to file its annual Form 990 Return with the IRS until the fifteenth day of the fifth month after the close of its fiscal year. (This is, in each case, not taking into account any possible extensions.)

Thus, an organization with a June 30 fiscal year end is required to file its annual Pennsylvania charitable solicitation registration statement no later than November 12. But it is not required to file its IRS Form 990 Return until November 15. Moreover, although the Bureau automatically grants all organizations a 180-day filing extension from the initial due date (without the need to request such an extension), for organizations that also obtain a six-month extension of time to file their IRS forms, the filing date inconsistency persists. For instance, under current Pennsylvania law, the organization in our example with a June 30 fiscal year end must file annually (taking full advantage of the automatic 180-day extension) no later than May 11 of the following year. However, that same organization must file its IRS Form 990 Return by May 15. While a three- or four-day discrepancy in due dates may not be a big deal, for those organizations that need as much time as possible to prepare their Form 990 Returns, the inconsistent filing dates can be a nuisance that comes at a very busy time.

When the new legislation takes effect on December 13, 2014, this nuisance will be relegated to the history books, and charitable organizations will have until the fifteenth day of the fifth month following the close of their fiscal years to file registration statements with the Bureau. Alternatively, if they are relying on an automatic extension, they will have until the fifteenth day of the eleventh month following the close of their fiscal years. In each case, these due dates will be consistent with the due dates for filing their IRS Form 990 Returns.

November 06, 2014Please be aware that (updated 10/21/2014) ANNUAL BUSINESS SERVICES or COMPLIANCE SERVICES or CORPORATE RECORDS SERVICE (not to be confused with the Washington corporation, Compliance Services, Inc) are mailing notices to business entities requesting that "Annual Minutes" and a fee of $125.00 be sent to them for filing.

These notices are NOT from the Washington Secretary of State, Corporations and Charities Division. "Annual Minutes" are NOT required to be filed with the Secretary of State. They are to be kept by the business entity itself. Do NOT confuse these notices with the annual report notices sent by the Washington Secretary of State, or the Business Licensing Services at Department of Revenue reminding each business to file its 2014 annual report.

If you have questions about these notices please contact the Corporations and Charities Division at corps@sos.wa.gov or call 360-725-0377.

September 15, 2014Effective October 1, 2014, the Annual Charity Registration Fee for non-profits receiving more than $500,000 in charitable contributions will increase from $200.00 to $300.00.

September 01, 2014 - Corporate Filing Solicitation targets Mississippi BusinessesThe Secretary of State′s Office has received numerous complaints regarding a company called ″Annual Business Services,″ which has apparently been soliciting businesses across the State. In what appears as an official correspondence, Annual Business Services requests businesses to provide sensitive information and a check for $125.00. In return, the company would prepare an "Annual Minutes Requirement Statement″.

There is no ″Annual Minutes Requirement Statement″ form required by the Secretary of State′s Office.

The Secretary of State′s Office encourages Mississippi corporations to utilize extreme caution in the disclosure of sensitive information to outside vendors. This Agency does not require the submission of such information with the State of Mississippi and opposes the collection of such information for public dissemination.

July 22, 2014 - NEW YORK CHAR500Updated CHAR500 is now available on our Forms page. The update reflects the fee and CPA audit threshold changes that are in effect as of July 1st, 2014. Organizations with an original or extended due date after July 1st, 2014, should use the new CHAR500. The older version will continue to be accepted and evaluated consistent with the new requirements.

November 15, 2013 - Law change affecting Connecticut registered charitiesA recent law change in Connecticut has been implemented which will affect the expiration date for all registered charities. Specifically, charities will now expire and have to renew 11 months after their fiscal year end. Therefore, all charities with a June 2013 fiscal year end have had their expiration dates changed to May 31, 2014.

August 22, 2013 - Arizona charitable law change20 June 2013, Arizona Governor Janice K. Brewer signed into law that Charities soliciting donations in Arizona will no longer be required to file with the Secretary of State′s Office as of September 13, 2013.

If a charity chooses to file with SOS for the 2013 year, it must do so by September 12, 2013.

If a charity chooses to become current for past delinquencies, it must do so by September 12, 2013.

If a charity is delinquent prior to 2013, it must become current, pay the delinquent filing penalties and file 2013 by September 12, 2013.

Filings submitted after this date will be returned.

July 08, 2013 - New Mexico Attorney General′s OfficeDue to the recent outage affecting NM-COROS, delinquent statuses will not be added until after 7/8/2013.

June 24, 2013 - Changes to Charities Program filing feesLast fall, the Colorado Secretary of State ‐ Charities Division announced that Charities Program filing fees would be reduced to $1 beginning October 1. The announcement indicated they would be reviewing the fee reduction on a quarterly basis, to ensure that the funds coming into their office are sufficient to cover their operations, as required by state law.

Beginning July 1, the previous fee structure will be reinstated. See the table below for a list of fees effective July 1.

If you have any questions, please feel free to contact the Charities Program at 303-894-2200, option 2.

Transaction Fee as of July 1

Charities database, CD copy: $50

Charitable Organizations Application for new registration number: $10

Amendment to registration statement: $10

Annual registration renewal: $10

Paid Solicitors and Professional Fundraising Consultants

Application for new registration number: $175

Amendment to registration statement: $25

Annual registration renewal: $175

Solicitation notice: $75

Solicitation notice amendment: $25

Effective April 10, 2013, the following changes were made to the Game Promotion Statute:

* A game promotion may only be conducted by a for-profit commercial entity on a limited and occasional basis as an advertising and marketing tool in connection with and incidental to the bona fide sales of consumer products or services.

* Non-profit entities and charitable organizations may not operate a game promotion.

* An ″operator″ of a game promotion means a ″retailer who operates a game promotion or any person, firm, corporation, organization, or association or agent or employee thereof who promotes, operates, or conducts a nationally advertised game promotion.″

* Importantly, compliance with the rules of the Department of Agriculture and Consumer Services does not authorize and is not a defense to a charge of possession of a slot machine or device or any other device or a violation of any other law.

* A violation of section 849.094, Florida Statutes, or soliciting another to commit an act that violates the section, constitutes a deceptive and unfair trade practice actionable under the Florida Deceptive and Unfair Trade Practices Act.

The Secretary of State is warning all businesses of a deceptive solicitation they may receive. Attached is a copy of this solicitation. It is NOT from the Secretary of State or any other government agency. If you receive such a solicitation you DO NOT need to mail and pay $125 fee. Annual minutes are not something that is a required filing with this office. If you have any questions please contact the Compliance Division at compliance@wyo.gov or 307-777-7370.

The Corporation Commissioner for the State of Georgia (the "Commissioner") has determined that:

1. Due to the implementation of an upgrade to the Corporations Division′s website, there has been a delay in the filing of annual registrations online.

2. Allowing filers an extension in filing 2013 annual registrations is in the public interest.

3. Pursuant to O.C.G.A. §§ 14-2-130, 14-3-130, 14-9-1102, 14-11-1105, and Ga. Comp. R. & Regs. r. 590-7-4-.11 and r. 590-7-13-.11, the Commissioner has the authority to extend the time of filing of annual registrations.

In accordance with the above, the Commissioner hereby orders the extension of the deadline for filing annual registrations for calendar year 2013 from April 1, 2013 to May 31, 2013.

February 08, 2013The Vermont Secretary of State has announced that, because of late mailing of notices to file, this year′s due date for Annual Reports from entities with a December fiscal year ending has been extended from March 15 to April 30. This year′s due date for Nonprofit Biennial Reports has also been extended from April 1 to April 30.

November 08, 2012 - Preventing Waste through AdvocacyAdvocacy, collaboration, and the power of a strong network recently proved to be a winning combination in North Carolina. In September, North Carolina's Secretary of State announced new procedures for verifying the legal status of nonprofits with charitable solicitation licenses that would have negatively impacted out-of-state nonprofits. Specifically, non-resident nonprofits would have been required to obtain ‐ at a cost ‐ and submit to the State a formal copy of a Certificate of Authority or similar document. The North Carolina Center for Nonprofits recognized the wasteful burden of the requirement and reached out to state association colleagues across the country who helped demonstrate to the Secretary of State that her proposal would create a new, unfair expense for nonprofits in their states. The Secretary of State responded favorably to the expert insights and modified the rules so that her office will now allow out-of-state nonprofits to print a screen shot from the website of the appropriate state agency to show that they are in good corporate standing. It's been estimated that the policy modification will collectively save nonprofits more than $150,000 annually in processing and copying costs outside of North Carolina. The solutions developed through engagement with elected officials eliminated a costly, multi-step process that would do nothing to enhance the integrity of nonprofit.

July 17, 2012 - Notice regarding "Compliance Services" SolicitationRecently, an entity calling itself "Compliance Services" mailed solicitations entitled "Annual Minutes Requirement Statement Directors and Shareholders" to numerous Massachusetts corporations. This solicitation offers to complete corporate meeting minutes on behalf of the corporation for a fee. Despite the implications contained in the solicitation, Massachusetts corporations are not required by law to file corporate minutes with the Secretary of State.

You do not have to do business with Compliance Services. The forms provided by them are not required by the Office of the Secretary of State. Whether you choose to do business with them will in no way affect your corporate filing with the Secretary of State, either positively or negatively.

It is important to remember that any official statement or request from the Office of the Secretary of State will clearly indicate its origin by displaying the name of Secretary of State William Francis Galvin.

May 18, 2012Each year, the Mississippi Secretary of State's Office holds study groups composed of business and community leaders across the State to develop, promote, and identify ways to make Mississippi's laws the best in the country. During the 2009 Legislative Session, the State of Mississippi made several revisions to the Mississippi Charitable Solicitations and Nonprofit Corporation Laws. Charities and nonprofits operating in Mississippi have had a few years to operate under these revisions, and they would now like your input on any changes which may benefit your organization. Their goal is to identify ways to promote efficiency in State government. If you have any suggestions regarding Mississippi's charity or nonprofit laws, please contact Drew Snyder, Assistant Secretary of State for Policy and Research, at (601) 359-3101.

Reminder: Exemptions for Membership Organizations Under the Mississippi Charitable Solicitation Act, certain organizations may file an exemption with the Secretary of State's Office to solicit charitable funds in the State. It has come to the attention of our Office that many membership organizations may not be aware of the requirement to file an exemption with our Agency. Some organizations which qualify for an exemption include:

- Parent Teacher Associations and booster clubs;

- Fraternal, Patriotic, Social, Educational, Alumni Organizations or Historical Societies;

- All volunteer fire departments or rescue units;

- Any humane society; and,

- Any charity which does not intend to solicit and receive contributions in excess of $25,000.

If you have a question regarding your ability to solicit funds in the State of Mississippi, please call us at (877) 275-2767.

Disabled Veterans National Foundation A Washington, D.C. charity registered to solicit funds in the State of Mississippi was recently featured in a CNN investigation for squandering millions on administrative expenses rather than assisting disabled veterans.

Remember, the Better Business Bureau recommends at least 65% of total revenue of a charitable organization should be spent directly on its charitable purpose. To check your charity, please visit the 2011 Report on Charities issued by the Secretary of State's office at www.sos.ms.gov.

May 10, 2012Florida

House Bill 827

Effective April 6, 2012, amends the Nonprofit Corporation Act by authorizing limited agricultural associations to convert to nonprofit corporations.

View entire bill on the state′s website.

Senate Bill 3024

Effective April 9, 2012, amends the Business Corporation Act regarding short form mergers involving publicly traded corporations.

View entire bill on the state′s website.

Effective April 20, 2012, amends the Nonprofit Corporation Act by repealing authorization for conversions.

View entire bill on the state′s website.

Senate Bill 6255

Effective March 30, 2012, amends the Not-for-Profit Corporation Law regarding cemetery corporations.

View entire bill on the state′s website.

See Part L, Section 23.

Senate Bill 36

Effective May 8, 2012, provides that domestic corporations will be allowed to transfer or redomesticate to another jurisdiction.

View entire bill on the state′s website.

House Bill 2239

Effective June 6, 2012, amends the Business Corporation Act to authorize new or existing corporations to become social purpose corporations with the purpose of promoting one or more social purposes as defined in the bill.

View entire bill on the state′s website.

Effective June 6, 2012, amends the Nonprofit Miscellaneous and Mutual Corporations Act regarding notices sent to the members of consumer cooperatives and authorizing consumer cooperatives to hold annual meetings by means of electronic or remote communication.

View entire bill on the state′s website.

Senate Bill 391

Effective April 20, 2012, revises the Department of Financial Institutions' procedure for providing notice of an administrative dissolution or revocation of a corporation or LLC.

View entire bill on the state′s website.

Attorney General Eric T. Schneiderman has announced a comprehensive plan to revitalize New York′s nonprofit sector. Coming during a period of enormous challenge to nonprofits, the Attorney General's plan includes legislation that will reduce burdens on nonprofits and enhance oversight and accountability. To strengthen governance practices, the plan also includes new partnerships with the business and academic communities to recruit and train nonprofit boards of directors.

The Attorney General's reform plan responds to recommendations made by the Leadership Committee for Nonprofit Revitalization, a group of 32 nonprofit leaders from across New York that Attorney General Schneiderman convened last summer. The Committee issued its recommendations in a detailed report released Thursday.

January 19, 2012 - New York's Charities Bureau Accepts IRS Filing Extensions for Electronic Filers.The IRS announced that it is granting filing extensions to organizations that file electronically and whose Form 990 is due in January or February 2012. Those organizations have until March 30, 2012 to file their Form 990s.

The Attorney General's Office will grant the same extension to organizations that file with the Charities Bureau. An organization that qualifies for the IRS extension will similarly have until March 30, 2012 to file its CHAR500, IRS Form 990 and, if applicable, financial audit or review. Please note that this extension is available only to organizations that file electronically with the IRS.

To be eligible for the extension, an organization must send an email to the Charities Bureau at charities.extensions@ag.ny.gov stating that (1) it files electronically with the IRS, (2) its annual report is due to be filed in January or February 2012, and (3) it will file the report with the Charities Bureau on or before March 30, 2012. The organization should put its name and Charities Bureau Registration Number in the subject line of the email.

Organizations requesting an extension should not submit a partial filing to the Charities Bureau. They should wait until the Form 990 has been filed with the IRS, but not later than March 30, 2012.

June 27, 2011 - New York's Attorney General announces new leadership committee for nonprofit revitalization.At an April meeting of the Association for a Better New York, the Attorney General, whose office oversees nonprofits operating in New York State, announced that he would work with the state's nonprofit sector and business and labor communities to help eliminate unnecessary bureaucracy that has long plagued nonprofits, such as redundant audits and overlapping reporting requirements, and delays in processing and payment of contracts. Based on the key issues that the nonprofit sector has identified to the Attorney General's Office, the Leadership Committee's activities will focus on the following:

- Making recommendations on how to reduce regulatory burdens and more effectively address regulatory concerns;

- Developing legislative proposals to modernize New York's nonprofit laws that would eliminate outdated requirements and unnecessary burdens while strengthening accountability; and

- Proposing measures to enhance board governance and effectiveness, including through new programs to recruit and train nonprofit board members.

Major changes in COSA include:

- Charitable organizations are required to register to solicit instead of being licensed to solicit. An organizations registration will be effective upon receipt of all required information.

- The level of contributions at which all-volunteer organizations are required to register has been increased. They may now receive up to $25,000 in a twelve-month period before being required to register with the Charitable Trust Section. If any person who is involved in fundraising is paid, registration to solicit is required regardless of the amount of funds raised.

- Criminal provisions in COSA have been strengthened and certain violations are now felonies.

- Civil fines are authorized up to $10,000.

New York State Attorney General Eric T. Schneiderman today filed a lawsuit against an Albany-based company that issued thousands of notices designed to look like they were from the New York government, and bilked thousands of New York corporations and nonprofit charities out of more than $1 million. By issuing solicitations designed to look like official government notices.

April 25, 2011 - Some West Virginia Charities Will Be Affected By Changes In State LawSome charities in West Virginia will be affected by a change in state law that determines whether an audit or a financial review would need to be submitted along with registration documents to the Office of Secretary of State. Charitable organizations raising more than $200,000 per fiscal year in contributions, excluding grants from governmental agencies or private foundations, will be required to submit an audit performed by an independent certified public accountant. An audit of a charitable organization′s finances is extremely detailed while a financial review provides a more general analysis. The law was passed to help smaller charities save money by not having to perform a full audit while at the same time providing accountability to donors. The new law also provides a new definition of ″solicit or soliciting″ that includes electronic means like e-mail, instant messaging, electronic bulletin board, or internet technology.

April 25, 2011 - Washington Secretary of State - Charities UnitThe Charities Program is working diligently with customers to fulfill every request. However, with recent budget cuts and increased volumes, you may experience intermittent delays. If you choose to file with expedited service, your filing will be considered with priority in the expedite order that it was received. We appreciate your understanding and patience as we work to process your requests as quickly as possible.

April 25, 2011 - Changes in Filing Fees for Charity Registrations in WashingtonDuring the 2010 Legislative Session, the Charitable Solicitations Act was amended. As a result, many of the filing fees have been changed to fund an education and outreach program for charitable organizations.

Charitable Organization initial registration fee: $60

Charitable Organization annual renewal fee: $40

Expedited (2-3 day) service fee: $50 for paper or in person filings.

Secretary of State of Colorado issues warning to corporations and non-profits of schemes preying on corporations unfamiliar with filing requirements in Colorado.

State forms always have the filing fee indicated on the form unless the fee is determined by financial information that the corporation itself must provide the state. At ARMS, we will always review all fees and disbursements for any filing with our customers and detail all calculations. Beware of anyone offering to file a form for a flat fee that includes the state fee. These should always be separated on any invoice so you can track your fees to the states on an annual basis for budgetary purposes.

January 25 2011 - Pennsylvania Bureau Keeping a Watchful Eye On CharitiesThe state department this year reached consent agreements with 55 charities, a record number. In the three previous years, a total of 47 cases were settled, according to an online case archive. Organizations were fined $228,850 this year, with individual charities agreeing to pay fines ranging from $2,500 to $20,000. The increase does not signify an upswing in shady groups soliciting donations from Pennsylvanians, said Larissa Bedrick, deputy press secretary for the state department. "It is due to the fact that the department was able to have a prosecutor almost fully dedicated to charity cases this year,″ Bedrick said.

December 22 2010- New Mexico Late Fee Amnesty For Charitable Registration ExtendedThe late fee amnesty period has been extended to February 10, 2011. This allows charitable organizations that are past due or operating without being registered with the AG′s office to get up to speed without financial penalties. The extension allows charitable organizations in New Mexico to become familiar with the New Mexico Attorney General′s Office new charitable solicitation electronic registration system while helping them comply with charitable registration requirements.

December 22 2010 - The New York State Attorney General′s Registration Cure ProgramThe New York State Attorney General′s Registration Cure Program has been extended through December 31, 2010. The program offers a cure period for charities not properly registered with the Charities Bureau or delinquent in filing annual financial reports. The Attorney General will waive financial penalties if organizations file required forms and pay required fees. This program is an opportunity for charitable organizations to become compliant with the charitable solicitation registration requirements without incurring penalties. All organizations required to register with the Charities Bureau are eligible to participate in this program. A completed application must accompany the filings and be postmarked on or before December 31, 2010.